Since I discovered the mighty Southwest Companion Pass, which allows one person to fly free with you on any booked flight after accumulating 110,000 Southwest points, I’ve been on a mission to earn this sucker. Only one problem… I was right in the middle of purchasing a home. I thought I’d share my journey for others who might be in the same boat.

Download my free guide: “The Step-by-Step Guide to Earning Your Southwest Companion Pass” for more tips on how YOU can earn the pass!

The Background

In 2015, I began to research miles and points after being introduced to the fabulous Million Mile Secrets blog. As a couponer, I was hooked. This was a way to earn FREE travel through smart use of credit cards to pay everyday bills and then pay them off immediately. Why not earn a return on money you are ALREADY going to spend?

However, that spring we began negotiations to purchase the home we were living in. Million Mile Secrets and other miles and points bloggers do not recommend engaging in this hobby if you are planning to secure a mortgage in the near future, but this was killing me not to get started. After much research, I determined that 1 or 2 cards would likely not greatly reduce my credit score, thus affecting the interest rate I could secure on my mortgage.

To earn the Southwest Companion Pass most easily, you need to sign up for both their Chase Southwest Premier Business credit card and one of the Chase Southwest consumer cards when each have a 40-60,000 mile bonus for signing up and spending $1000-$2000 dollars within the first few months.

You then typically only need another 6000 or so miles (depending on the bonuses you received), as you’ll earn 2000 miles for the $2000 you have to spend to meet the minimum spend. Download my free guide to flying free on Southwest below for tips on how to make this happen.

Step 1 – Apply for Chase Southwest Business Card

Note: To apply for any of the credit cards mentioned in this post, please start at the TRAVEL CREDIT CARDS link in the Go to Travel Gal main menu above. This allows me to earn a commission — at no cost to you — to help pay the blogging bills :), so I can continue to bring you great information free! I sincerely appreciate you taking this step!

The 50,000-point offer came up for the business version of the card, and I was afraid I would miss it before they took it away, so I went ahead and signed up.

I was initially declined and had to call the Chase reconsideration line and was successful by phone. I quickly met the minimum spending requirement and soon had my 50,000 points. Step 1 complete.

Note, this credit card sign-up did NOT affect my credit adversely other than perhaps a drop of less than 5 points. What impacted my score more (and which everyone assured me would not) was all the credit pulls associated with my mortgage application. Ugh!

The 50,000 miles allowed my family and I to travel from Indianapolis to San Diego in fall of 2015 where we enjoyed an absolutely fantastic vacation!

Step 2 – Apply for Chase Southwest consumer card

After the credit pulls dropped my score, I was terrified to sign up for any more cards until the mortgage was complete. Unfortunately, these negotiations over the price of the home and repairs to be made took six months! So I tried to be patient, waiting until the process was complete in late September to continue my quest.

At this point, the 50,000-point offer on the Chase Southwest Rapid Rewards personal card was not available. When it did become available again, my credit score was still hovering in the high 600s (after a peak in the 720s this summer) and I was afraid I would be declined.

BUT if you do not get the rest of your points needed for the Companion Pass before the end of the year, you do not get a companion pass and can’t sign up for the cards again to get the bonuses for 24 months after closing the account. Boo!

So I decided it was now or never; I might as well try and see what happened. With the 50,000-point offer for the Southwest Rapid Rewards Premier card still available, I applied in early November 2015. And low and behold, I was approved. Apparently, I should have done it sooner.

Step 3 – Spend $2000 to Earn the Second 50,000 points

So that put me in a scramble to meet the minimum spending of $2000 before the end of the year to score my 50,000 points. Because I waited so long to apply, I did not have time to pay my November mortgage payment via Plastiq (a system that for a 2.5% fee allows you to pay bills like mortgages via a credit card, though you can no longer pay a mortgage with a Visa or AMEX card), which would have been the easiest way to do so.

I went ahead and paid the first mortgage payment directly from my checking account and then paid December’s payment early along with a few other medical and cable bills with the new Southwest card to meet my $2000 minimum.

Next I called to make sure these payments registered on the credit card and then determined roughly when the points would be deposited to my Southwest account. With both cards, they were applied fairly quickly.

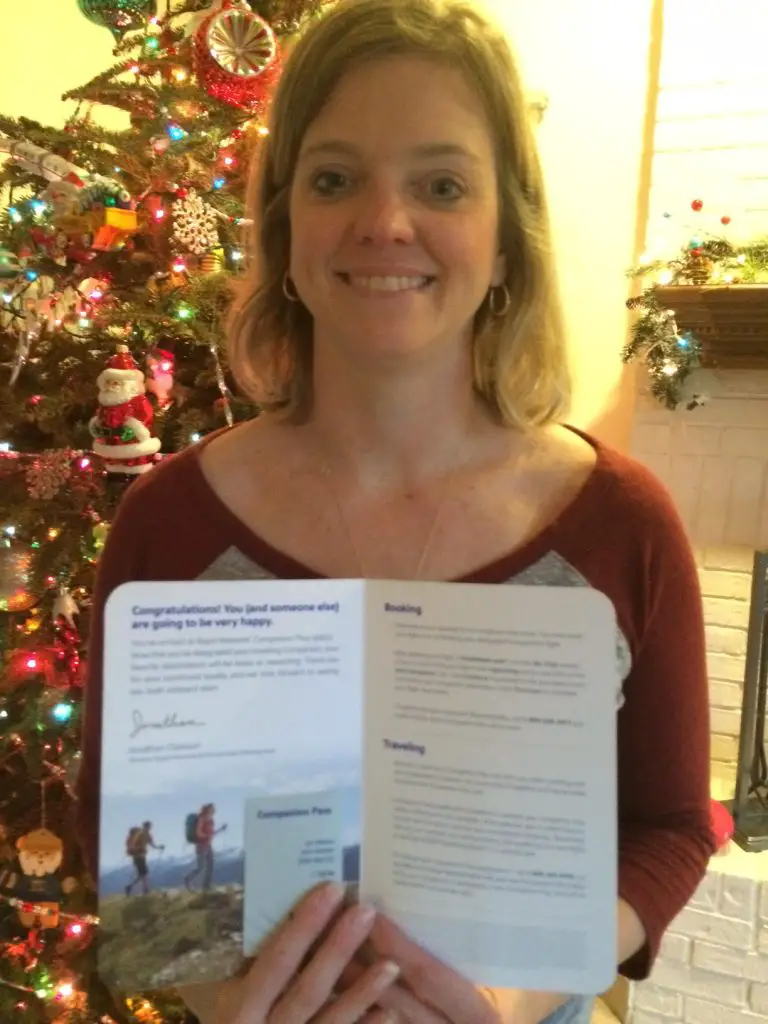

In early December 2015, I received an email that I had officially reached Southwest Companion Pass status and the actual pass arrived in the mail just before Christmas! Talk about cutting it close!

Should you try to earn the pass late in the year like me?

Earning your 110,000 points late in the year is NOT ideal. Once achieved, the Southwest Companion Pass becomes effective immediately and does NOT expire until the end of the following year. The perfect scenario would be to try and earn it in January or February so you’d have almost two full years to use it. Here’s an ideal timetable for when to earn the pass.

I figure, better late than never, and at least we had it for a year.

How We Use the Southwest Companion Pass

I really love flying Southwest. We’ve had nothing but great experiences since flying this airline out of Indianapolis after having a terrible time on Frontier (never again!).

Two of our favorite haunts are California and the Rocky Mountains, and Southwest regularly has some really awesome deals to these locations. We try to book our tickets during their sales when usually our family of four can fly for 50,000 points or less (it is now be less since one of us always flies free).

Even if we don’t end up traveling when we thought, we can always cancel or change for NO fee due to Southwest’s policies.

Other good deals out of Indy regularly are Washington, DC and New York City. We are also only 2 1/2 hours from Chicago’s Midway airport, so we can always fly out of there as well to score better rates to other cities.

And we love being able to take two checked bags per person (we usually only take one checked bag per person really, but even that is a huge perk), as well as one personal item and one carry-on per person without being charged for every single thing. Yea!

Want to get started flying free like my family? First step: Download my free guide “The Step-by-Step Guide to Earning the Southwest Companion Pass” and you’ll be on your way!

- Why It’s Easy to Fly Free on Southwest

- Southwest Credit Cards with 50,000-Point Bonuses

- 11 Ways to Meet the Minimum Spend on Your Southwest Credit Card

- 6 Reasons to Start Earning Your Companion Pass NOW

- 8 Reasons Why I LOVE to Fly Southwest!

- Top 10 Most Frequently Asked Questions About the Southwest Companion Pass

Author

-

Lyn Mettler is a longtime travel writer for US News & World Report, USA Today 10Best and The TODAY Show who created Families Fly Free, a program which teaches families her simple system to use travel rewards to fly for free.